Dropsuite

A fast growing compounder riding multiple secular trends, available at an attractive valuation

Overview

Dropsuite (ASX: DSE) offers an opportunity to invest in a fast-growing compounder with the best product in the secularly growing online backup market for SMBs serviced by managed service providers (MSPs).

I conservatively estimate the business will be worth 2-3x what it is today at YE 2028 (current market cap is AUD ~140m), with a continued compounding opportunity from there. Pending a few further diligence items (see “further diligence items”), I would recommend Dropsuite equity as attractive at current prices.

First, some metrics. Dropsuite has:

ARR of AUD ~25m, and grew ARR 67% in the last year

NRR of 125% and churn of less than 3% -- this is a mission-critical product that does not get cut easily

Gross margin of 63%

An 8% operating margin, including SBC in FY 22 (profitable!) and a was also free cash flow positive

The company trades at EV/ARR of slightly under 5x, EV/2023E gross profit of ~6x. Even in this environment, that is cheap. So, what is the market missing?

The market perceives Dropsuite to be a subpar business because (1) it sells to end users through IT distributors / MSPs, and not directly, and (2) Dropsuite’s top 10 distributors account for ~65% of revenue. Both are not as large risks as they appear [1].

The market perceives online backup as a commodity market, with dozens of players offering more or less the same service and having no pricing power. In reality, there are several key vectors of differentiation, and Dropsuite wins on most of them [2].

The market doubts Dropsuite has a path to “SaaS level profitability” of 20%+ operating margins, inclusive of SBC. In reality, Dropsuite’s business is already profitable, has immense operating leverage, and the path to margin inflection is very clear.

Context

There are already several good explanations online of what Dropsuite’s product does and why it is necessary, so I won’t spend much time on it. The short of it is that even when companies use hosted products like Office 365 and Google Workspace for email, contacts, and calendar, the underlying data needs to be backed up. This is to protect against (1) actual data loss on the part of Microsoft/Google, which they don’t take responsibility for or (2) inadvertent deletion of data by employees/sysadmins, cybercrime, etc.

Historically, SMBs didn’t realize or care about data backup – only ~12.5% of SMB Office 365 seats had backup – but they increasingly do as a result of bad personal experiences with data loss, horror stories about ransomware, etc. Today, closer to 15% of SMB Office 365 seats are backed up, and this continues to trend higher. Furthermore, SMBs increasingly care about backing up other SaaS applications with mission-critical data – think CRMs, HCMs, and accounting software. The market is secularly growing.

The second key trend is that more SMBs are leaning on managed service providers (MSPs) to manage their IT, particularly their software stack. In 2019, ~10% of SMB IT spend was managed by MSPs. Today, it is closer to 20%. Proliferation of SaaS applications, more security risks, and more compliance requirements are a few of the drivers of this secular theme.

Dropsuite sits at the intersection of these two trends. It is a provider of backup software to SMBs through the MSP channel.

The way this works is: an MSP will decide that Dropsuite is its backup vendor for a particular application (Office 365, for example), and then offer that backup product to all of its SMB customers. In return, the MSP will get a ~30% cut (if the end customer pays $3/user/month, the MSP gets $0.90/user/month). The key point is that the SMB is not really the customer of Dropsuite’s product – the MSP is. SMBs will not spend time researching which backup software they should use – they’ll use whatever the MSP recommends. That’s why they’re using an MSP is the first place.

Many MSPs buy all the software products that they offer through the large IT distributors, such as Pax8, Ingram Micro, and Tech Data. They do this to get increased levels of support from vendors, and in some cases, better negotiated prices. So, the key for Dropsuite is to be offered through these large distributors, and then generate enough awareness and word of mouth among the MSP community that they get picked. The distributors also get a cut for offering the product — typically ~15%.

Dropsuite’s largest products are Office 365 and Google Workspace backup, along with smaller website and Quickbooks Online products.

IT distributor / MSP channel risk

The IT distributor/MSP model is a source of concern for many investors. A channel-based sales model often sends investors running for the hills. Roughly 65% of Dropsuite’s revenue is through its top 10 distributors. So, the concern goes:

What happens if one of the top distributors drops Dropsuite?

Are channel partners as incentivized to push the Dropsuite product as Dropsuite selling directly?

Does Dropsuite win because of product or because they are willing to give more margin to distributors than other vendors?

Does Dropsuite still get the same level of user feedback if the product is sold through distributors?

The company doesn’t disclose what % of revenue its top distributor is, but I’d guess 10-20%. Clearly, a loss would be significant. However, it practically and business-wise wouldn’t make sense for a large distributor to drop Dropsuite. If a distributor is a large % of revenue, that means that many of its MSP customers are users of Dropsuite. Dropsuite is installed on all their end client systems, MSP staffed are trained on and comfortable with Dropsuite, and the distributor’s support teams are also trained on Dropsuite. If all those MSPs were one day told “you can’t use Dropsuite, you need to migrate immediately to another provider,” all the MSPs would have to spend lots of money migrating all their customers to a new backup provider, as well as retraining their staff. They would be pissed.

Thus, if there was some type of dispute between Dropsuite and a distributor, what’s more likely is that Dropsuite would not be offered to net new customers, and that distributor would slowly reduce service levels for Dropsuite to disincentive usage. Thus, 10-20% of revenue would not disappear overnight, it would dwindle over a period of quarters/years.

Moreover, the distributor makes their 15% cut on every sale of a Dropsuite product with almost no associated COGS (they just offer it on their portal), so they would experience a drop in high margin revenue from cutting it. Aside from a serious dispute over price, there is no incentive for a distributor to drop a product, just like there is no real incentive for Walmart to drop a top-selling product from its store.

On the point around the level of incentivization of channel partners to push the Dropsuite product, the retailer analogy remains relevant. Broadly speaking, the distributor is just a place of sale. Dropsuite drives demand for its own product, just like P&G drives demand for its products even though they are sold through Walmart. Most of Dropsuite’s customers come through word of mouth, and ~60% of Dropsuite customers see a demo from a Dropsuite sales rep before they buy.

However, in certain cases, the distributor may have a more heavy-handed role – and this can be a point of concern. Pax8 in particular reportedly pushes the Dropsuite product hard, and I suspect is Dropsuite’s top distributor. If this is because Dropsuite is “paying to play” with Pax8 by giving them more margin than other vendors do, it is problematic — eventually, a bidding war will break out and it will be a race to the bottom on price. Management claims they offer the same margin take rates to all distributors and MSPs. However, I need to independently verify (1) how the margin cut that Dropsuite gives to MSPs and distributors compares with what other backup vendors offer and (2) if Dropsuite gives better terms to Pax8 than other distributors.

Lastly, the concern about product feedback. Despite distributing through a channel, Dropsuite’s sales reps and product teams interface directly with MSPs frequently. Again, ~60% of Dropsuite customers interface with a Dropsuite rep before buying. Additionally, building out the direct-to-MSP sales motion is a 2023 priority for Dropsuite.

Competition / commodity market risk

The “continuity” section on the Pax8 marketplace, which includes backup, has 11 different vendors listed. Dropsuite’s investor deck mentions that there are 35 different Office 365 backup vendors globally. Naturally, investors look at the number of players as well as the MSP channel and think “commodity market.”

In reality, there are several vectors of differentiation around (1) product quality, (2) integration with PSA software and MSP user-facing web portals, (3) breadth of products backed up, and (4) depth of features beyond backup, like archiving / compliance.

Based on my reading of MSP online forums and some customer interviews, Dropsuite ranks well on all these. However, I will caveat this by saying that to come to a final conclusion, I’d need to run a full battery of 40-50 customer calls or an MSP survey to do a true competitive benchmarking.

Dropsuite stands out in particular on (4), with best-in-class archiving, search, and compliance functionality, according to commentary on MSP forums. Dropsuite is also making progress on (3), adding Quickbooks Online backup as well as full Teams backup (including 1:1 chat), which few other players do. Customer reviews also suggest that Dropsuite stands out on (1) general product quality – particularly UI/UX and usability. Overall customer sentiment for Dropsuite on online MSP forums is very high. All of this leads Dropsuite to have a higher price point than market, suggesting real pricing power for a differentiated product.

Bears will point out that Dropsuite is a point solution, while Datto, Spanning, etc. are platforms, and that SMBs would rather have a single platform than best of breed point solutions. While this may be true for a subset of MSPs, customer feedback suggests that MSPs evaluate best of breed for each individual product. This is because most vendors, including Dropsuite, offer smooth integrations into the PSA systems and web portals that MSPs use, so there is little additional integration complexity for using a point solution. Furthermore, distributors offer support and installation guidance for all supported vendors – so it is easier for MSPs to go best of breed than if they were purchasing directly with each vendor.

The last point on competition is that many top competitors are PE-owned, have legacy products, and are milking cash rather than investing. This sets up favorably for Dropsuite.

A prime example is Datto, which is the the 800-pound gorilla in MSP software. Datto was owned by Vista, taken public in 2020, and then taken private again by Insight’s rollup Kaseya in 2022. After the Kaseya acquisition, Datto apparently raised prices on its competing Backupify product by 40-80%, according to online forums. Not confidence-inspiring.

Path to profitability

Dropsuite is already profitable, both GAAP and on FCF – so there is no capital markets risk. Furthermore, there is a clear path to 20%+ operating margins for the business.

For 2022, Dropsuite had gross margins of 63%. In opex, it spends ~42% of revenue on “staff costs”, 7% on administration and corporate costs, and 6% on advertising and marketing. The company doesn’t split out the allocation of staff costs to R&D vs. sales staff vs. administrative, but according to LinkedIn, ~50% of FTEs are in engineering/IT, ~10% are in sales/BD, and the remaining ~40% are not categorized by LinkedIn (incomplete title, unknown position, etc.). Based on this and management commentary, I’d estimate that of total revenue, 10-15% is S&M, 30-35% is R&D, and 10-15% is admin.

Note how little Dropsuite spends on S&M (10-15%). In contrast, Snowflake spends 50%+ on S&M and Datadog spends almost 30%. This is because of the partner-led sales model.

What does this mean for operating leverage? When Dropsuite is operating at scale:

Gross margins: should get well into the 70s, as they did for other storage-focused peers like Box and Dropbox, as well as Datto. Dropsuite claims “product gross margins” are already 70%, so as support costs as a % of revenue decline, overall gross margins should match this.

R&D: assume it terminally lands at 25% of revenue (Datto spends ~20% on R&D, Box ~25%, Dropbox ~40%) vs. close to 40% today. Strong operating leverage here.

S&M: assume it lands at 15-20% vs. 10-15% today. Datto spends a bit more than 20% on S&M.

G&A: decreases to 5% with scale.

This suggests a minimum 20% operating margin, including SBC, with upside as gross margin flexes higher. R&D can also be flexed down closer to Datto’s levels to drive increased profitability.

Valuation

My base case is that Dropsuite is worth AUD ~350m in 2028, vs. AUD ~140m today, with room for upside.

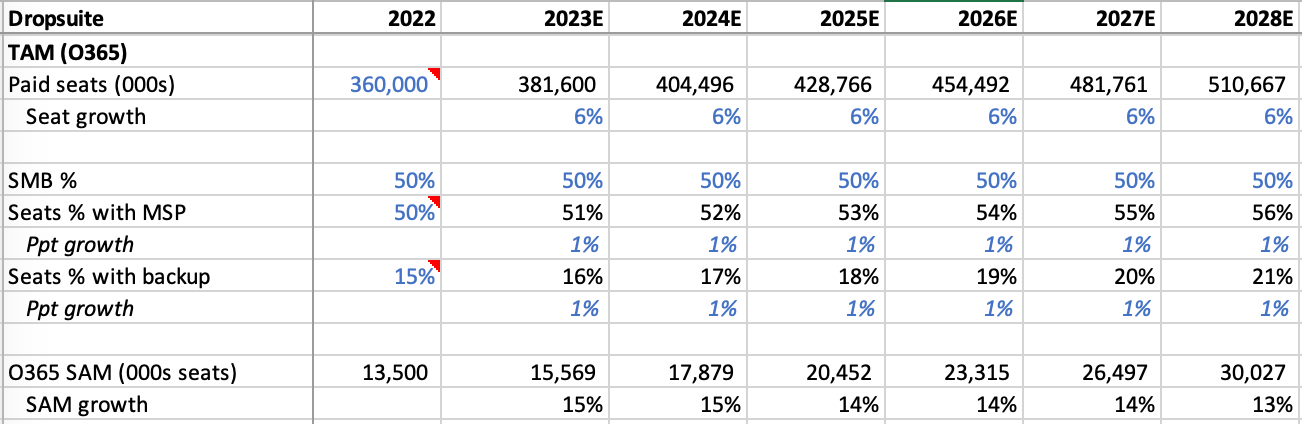

I project Dropsuite will generate AUD ~140m in ARR and AUD ~125m in revenue in 2028. I drive this off O365, with a total SAM for Dropsuite’s Office 365 backup product of ~30m seats, Dropsuite seat share of 13%, and ARPU of AUD ~3 (vs. 2.26 today).

Furthermore, I project Dropsuite will have a 22% operating margin by 2028, and pay 30% corporate tax (Australian rate), leading to AUD ~20m in after-tax profit by 2028. At a 15x net profit multiple, this is AUD ~300m in market cap, which combined with AUD ~50m in cash that I expect Dropsuite to generate in the interim period gets to AUD ~350m in market cap.

These are all directional estimates — you can play around with them based on your read of my assumptions.

Notes on the assumptions:

TAM product coverage – conservative: As a simplifying assumption, this TAM estimate is driven off of O365 alone. It does not include Google Workspace and Dropsuite’s other products, which contribute ~50% of revenue. The actual TAM is significantly larger, so there is a clear growth opportunity for Dropsuite even after YE 2028.

Office 365 seat growth – skews optimistic: I assume significant slowdown of O365 seat growth to 6% from ~30% CAGR from 2016 to 2022 as it (1) grows off a larger base, (2) COVID pullforward weans off, (3) likely recession impacts willingness to invest in expansion / seat growth. If we do enter a large recession, I can see seat adds to O365 come under real pressure especially for SMBs, and might even decline with layoffs.

MSP/backup share – skews optimistic: I project that both secular trends of (1) MSPs managing more seats and (2) more seats using backup will continue. I estimate 1 ppt increase in share per year for both. Again, in a recession scenario, I can see SMBs willingness to pay for value-added MSP services and backup decline – even though the long-term secular trend would remain intact.

Dropsuite seat share – skews conservative: I am projecting a significant slowdown in the rate of Dropsuite’s seat share growth vs. prior years due to a large base. Furthermore, Dropsuite’s growth is highly levered to market growth because Dropsuite wins a disproportionate share of incremental backup users (~80% of Dropsuite’s customers have never used backup before). In the event of a recession or other slowdown in market growth, Dropsuite’s seat share growth will get hit further to the downside.

ARPU – skews conservative: I am projecting a slowdown in ARPU growth from 20% CAGR from 2019-2022 to 5% CAGR moving forward. ARPU growth has been driven by upsell of (1) additional products and (2) additional functionality onto backup, like archiving and search. ARPU growth will continue but ~20% growth is unlikely in a recession scenario.

Margins – skews conservative: Most software companies target 20%+ GAAP operating margins. Dropsuite’s partner model has already proven to be more efficient, so on the back of lower S&M, Dropsuite’s margins should end up higher than average. My 22% estimate is therefore conservative.

Exit multiple – skew conservative: Why did I assign a 15x net income multiple if I think this business is going to be a profitable, 30% grower, and industry leader in ’28? As long as the top 10 distributor concentration remains high, there are going to be business quality questions. The company should re-rate if this is resolved.

Risks

“Pay to play” with top distributors, as described earlier. Is Dropsuite winning on product alone or because of unfavorable distribution deals?

Distributor concentration — there are mitigating factors I described earlier, but what I estimate being as much as 20% of revenue with one distributor is risky.

Recession – SMB IT spending will get hit in a recession, more so than enterprise IT spend. Dropsuite is priced per seat, so the 125% NRR will get hit as SMBs start cutting seats, instead of adding them.

“Microsoft risk” – Microsoft could offer its own Office 365 backup. It already offers Azure backup. This sounds scary, but Microsoft offering backup for Office 365 defeats the entire purpose of a backup – you want your backup to be with a different vendor, so that if Microsoft goes down, your data is not lost.

Management focus / capital allocation — Dropsuite did a AUD ~20m capital raise in August 2021 at 9x ARR that one could argue was issuing equity at too cheap a price. The company is now considering using the cash to do M&A. I’d prefer they focus on organic growth. I haven’t seen a clear articulation for why M&A is necessary at Dropsuite’s stage and growth profile.

Further diligence items

With more time, I’d need to complete the following additional diligence items before making a final conclusion on the company.

Complete competitor benchmarking (large N of customer calls or MSP survey) to:

Understand KPCs and KPC rankings for MSPs

Verify that there are vectors of product differentiation

Understand NPS, strengths, weaknesses, feature benchmarking, and pricing of each competitor

Verify that Dropsuite is considered a “best in class product”

Independently verify the following:

How does Dropsuite’s rev. share with distributors and MSPs compare with what other backup vendors offer?

How does Dropsuite’s rev. share with Pax8 compare with its other distributors?

Understand split of revenue among top 10 distributors. If one is significantly larger, why? Is there a level of revenue concentration that makes Dropsuite uninvestible?

Thanks to Collin McBirney of Topline Capital, who shared the original idea with me in 2021. All analysis in this article is my own.

Disclosure: I have a small long position in Dropsuite.

[1] Pending further diligence items.

[2] Pending further diligence items.